The evolution of Sumday

Role

Content design lead, content strategy, marketing materials,

The work

After we built a product from 0 to 1, I helped it grow into a resource for people saving for the future. Sumday started as an innovative and creative investment platform and matured into a more comprehensive investment platform for State Savings Plans to help simplify and democratize investing.

As Sumday's sole writer, I developed marketing communications for each plan, interface copy for registration and account setup, and all communication strategies. I also created employer toolkits to help employers promote savings plans and resources for our care team.

Impact

Sumday launched 6 ABLE Plans to help over 7,900 people living with disabilities save and invest

We launched two College Savings Plans and maintain over 139,000 beneficiary accounts

We successfully converted over 95,000 accounts to Sunday from a previous CSP provider

We provided one of the only fully-accessible investment platforms and assets (forms, prepaid card, etc.)

Sumday was sold to VestWell, which is a leading technology and service provider to states who offer public-sponsored savings programs

Registration

Registration process

Account overview

Dashboard with overview of their account and features, like getting a prepaid card or to accept donations from friends and family.

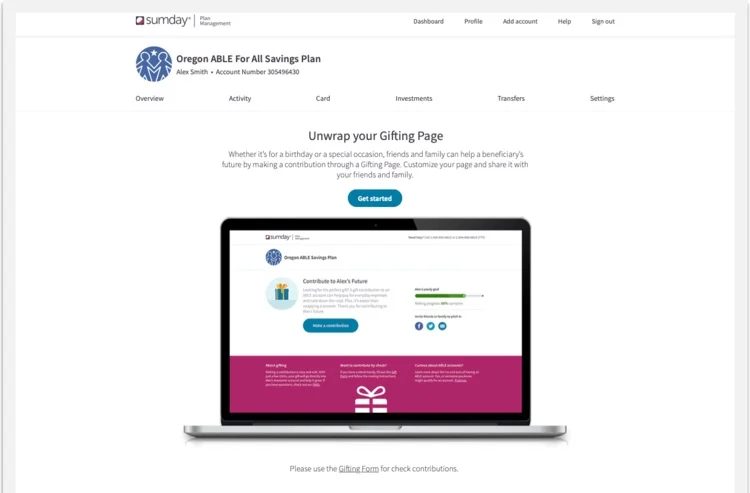

Gifting feature

Setting up a gifting page

Gifting page

Customization